What inspired you to become an author? I have always loved reading and writing. When I was in elementary school I endeavored to start a school newspaper and wrote all of the articles on my own! I recall writing about two editions before homework demanded more attention. In middle school, I won first place at a State Beta Club writing competition, and as an attorney one of my favorite parts of my job is writing. So writing has always been something I have enjoyed and it was natural for me to turn to writing when I thought of ways to impact and better the community and future generations. The idea for a children’s book fostering financial literacy stemmed from my own experience with the fast pace of change in the way we use money today, and recognition of gaps that exist in fundamental education for basic money management and business concepts. As a part of my professional journey, I measure success not only by my own progress but by how I am able to open doors and drive positive impact for others. If I reach the pinnacle of my career and have not done anything to share knowledge or actively help others, I would view that as a failure. So it is equally important to me to give back as it is for me to grow and succeed. Tell us about your book.

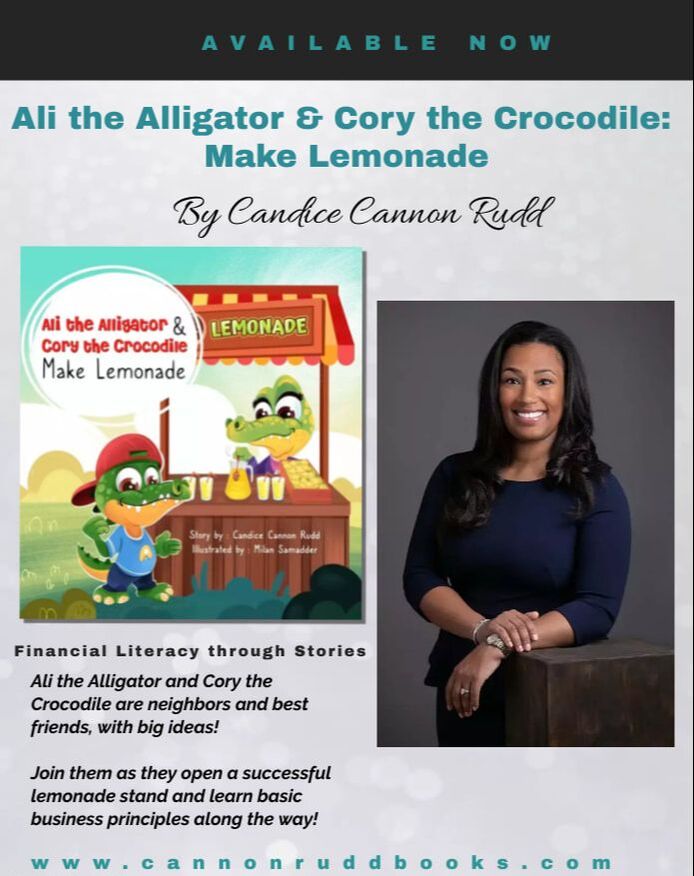

Ali the Alligator and Cory the Crocodile: Make Lemonade is a fun and vibrant story about two friends with entrepreneurial dreams who decide to open a lemonade stand for the summer. The characters each have unique traits - Ali is more sensible and thoughtful and Cory is very enthusiastic and outgoing. Each of these traits lend to the success of the business, but as the story goes on you learn that Ali’s approach is better for money management and Cory has to learn some restraint in spending. We all can identify with these characteristics, and the story highlights that financial skills and wise choices can be learned, and should be introduced early. As an introduction to basic financial concepts, the book will spur conversations about wants vs. needs, starting a business, supply and demand, and saving money. Parents and teachers should feel empowered to discuss these topics and potentially learn together through discussion. Exposing young minds to financial concepts early helps them appreciate the bigger picture and gives them the ability to make smart choices as they grow older. The book is recommended for young learners Ages 6-9, but it is fun for all! Why do you feel that most households don't discuss finances with their children? Money can be a taboo subject in a lot of households and is certainly not something most parents discuss with children. Finances are a touchy subject for most adults due to the innate nature of them translating into what we own, what we can afford, and what we may owe in debt. Further, many adults don’t gain money management skills until adulthood when bills had to be paid and bank accounts took on more significance in our lives. So I think it is not a subject people immediately discuss with kids because many times adults may feel they are still figuring it out themselves. I do believe it is important to break down that conversational barrier, as parents will find that kids are both interested and engaged. For a child, this is an area of life almost completely shielded from them, but I take the position that it shouldn’t be. They should understand why mom or dad has a job, and how money facilitates their activities and pays for their food and home. Even if parents don’t feel like experts, just starting the conversation is so important and opens the door to the household growing in knowledge together - which is extremely powerful and also beautiful. What should a child be able to comprehend from reading your book? With this book, I want to open the door for young kids to be knowledgeable about smart money management. After reading the book, children will have an appreciation for saving money and potential consequences of not spending it wisely. They will learn some new vocabulary, such as “entrepreneur” and “influx of cash.” Further, they should be able to form ideas about what their own business might look like. The aim is to introduce the concepts and start a conversation which should lead to greater understanding. What does success look like for your book. I want the next generation to be better equipped and to embrace financial literacy as a life skill, accessible to all. I hope that my books open a door to financial understanding for young learners and their families. Success for the book would be for it to reach and impact as many young learners as possible. How can we follow you? IG: @cannonruddbooks @candicecannonrudd Linked In: Candice Cannon Rudd Website: www.cannonruddbooks.com Contact: [email protected]

2 Comments

J Downing

4/26/2024 06:50:28 pm

Great work! Keep it up!

Reply

Chasity

4/27/2024 06:08:36 am

I love this! So much is true about financial skills not being learned until later in life. Thanks for sharing this message!

Reply

Leave a Reply. |

HoursM-S: 7am - 9pm

Tours on Tu&Sa |

Telephone214-702-3371

|

|